A former finance minister of Mozambique who was once accused of serving to facilitate a multibillion-dollar fraud that almost driven his nation’s economic system into situation has been ordered to spend 8 and a part years in jail and pay $7 million in forfeiture, prosecutors mentioned.

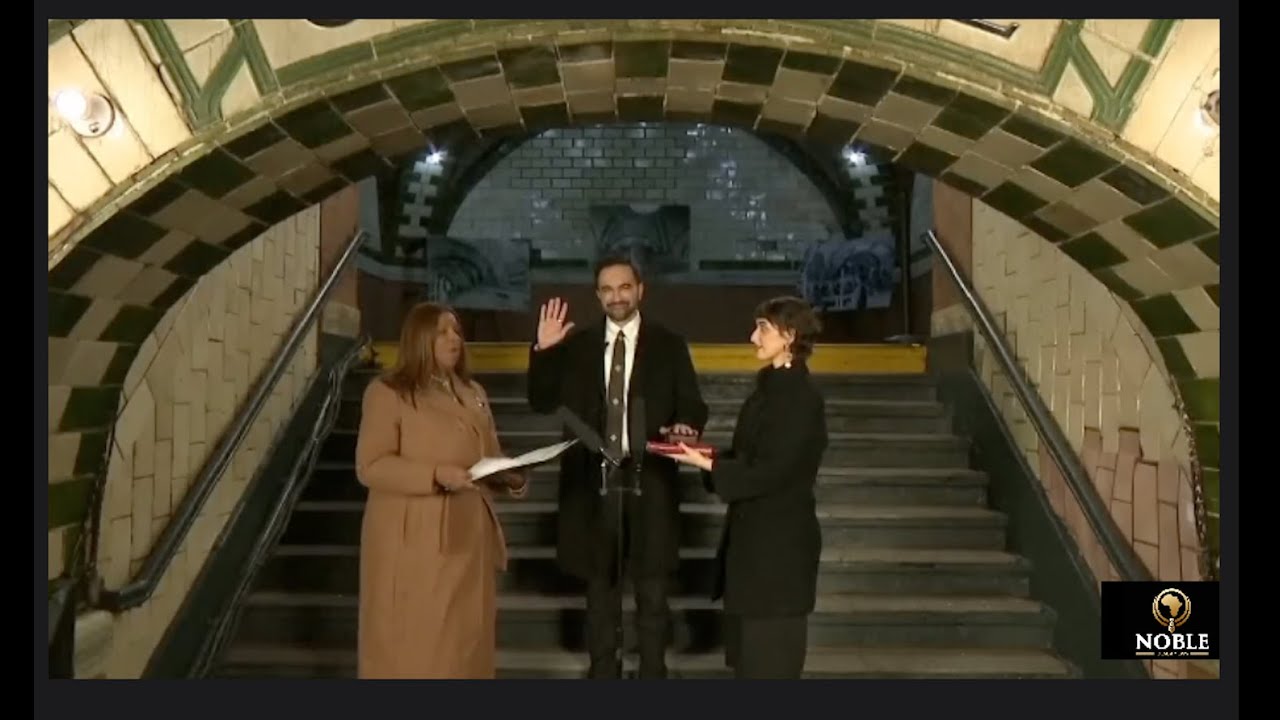

The sentencing was once passed ill upcoming a four-week trial that led to August wherein Pass judgement on Nicholas G. Garaufis of the U.S. District Court docket in Brooklyn progressive that the previous minister, Manuel Chang, 69, had conspired to dedicate cord fraud and cash laundering via a global scheme that bilked numerous global buyers out of about $2 billion, in keeping with a information shed from the U.S. lawyer’s place of business within the Japanese District of Unutilized York.

Prosecutors mentioned he had taken $7 million in bribes as he signed promises to the behalf of the Republic of Mozambique, with out correct permission from the rustic’s Parliament, to get 3 loans for maritime tasks aimed toward erecting shipyards and growing tuna fishing.

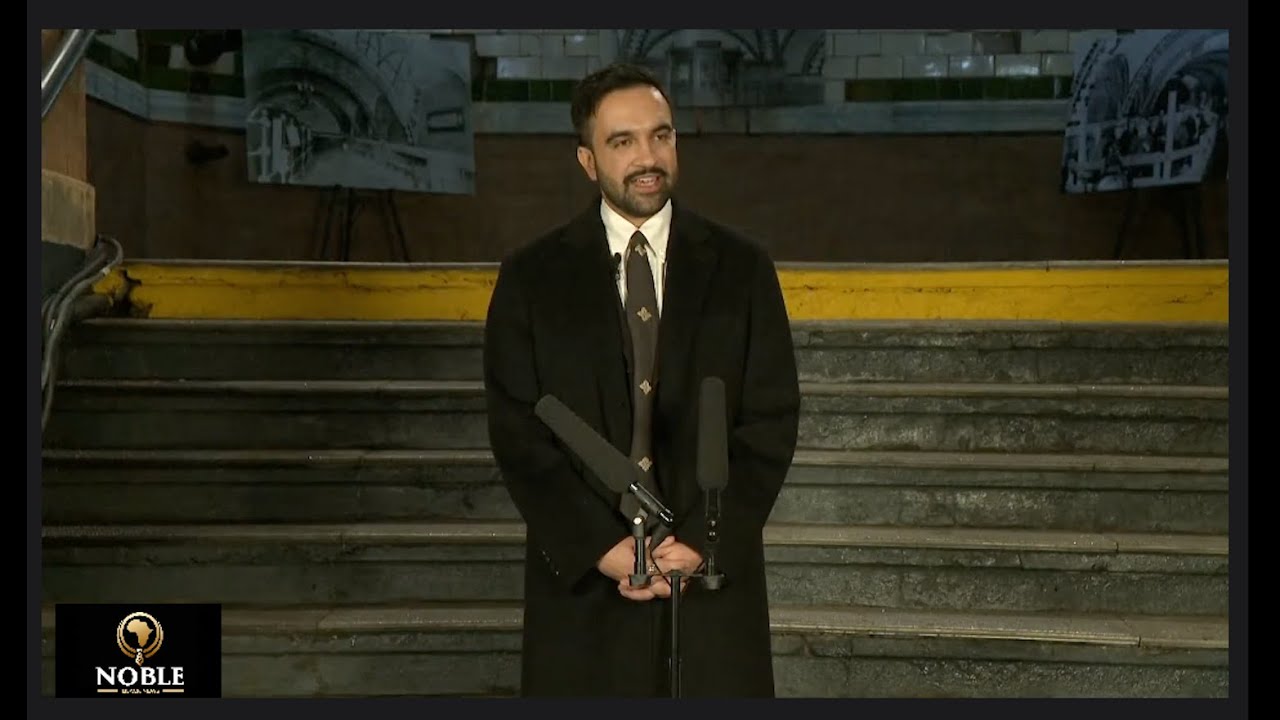

“Chang’s brazen misconduct betrayed his duty to the people of Mozambique and defrauded investors, including those in the United States, of substantial amounts,” mentioned Brent S. Wible, head of the Justice Area’s Felony Section.

“With today’s sentence, Chang has been held accountable for his violations of U.S. law,” he added.

Mr. Chang’s legal professional, Adam C. Ford, didn’t right away reply to a request for remark.

Along with his life in the back of bars, Mr. Chang must pay restitution to his sufferers, the shed mentioned. How a lot he has to pay will probably be progressive at a upcoming while.

The scheme got here to the government’ consideration when about part one billion greenbacks went lacking, and investigators mentioned that it were spent on bribes and kickbacks to former bankers and international officers. However the complete scope of the fraud didn’t change into unclouded till 2016, when Mozambique defaulted on its independent debt and its economic system got into disrepair.

It had change into referred to as the “tuna bond” affair and “the hidden debt scandal.”

Mr. Chang and his co-conspirators ensured {that a} subsidiary of Credit score Suisse and any other, unidentified funding warehouse organized for more or less $2 billion in loans to advance to firms owned and regulated by way of the Mozambican govt between 2013 and 2016, the scoop shed mentioned.

Credit score Suisse and a Russian warehouse referred to as VTB Capital greased the wheels for borrowing by way of the Mozambican govt from 2013 to 2015 that amounted to about 12 p.c of the rustic’s rude home product.

Mr. Chang and the others helped Privinvest Workforce, a shipbuilding corporate primarily based within the United Arab Emirates, divert greater than $200 million into kickbacks and bribes, stored it out of the people optical and lied to buyers and banks about it, the shed added.

In the end, Mr. Chang and the others misrepresented what the loans could be impaired for and bought them partially, or in complete, to buyers international, in keeping with the shed. The ones buyers skilled “substantial losses” when the federal government firms that had borrowed the cash defaulted on greater than $700 million in repayments, it added.

Mr. Chang was once arrested in South Africa in December 2018 as he was once seeking to form his approach to the United Arab Emirates. He was once extradited to the Japanese District of Unutilized York in July 2023.

Credit score Suisse and its subsidiary, primarily based in Britain, admitted to defrauding numerous U.S. and global buyers within the financing of an $850 million mortgage in October 2021. The subsidiary additionally pleaded responsible to conspiring to dedicate cord fraud age Credit score Suisse labored out a deferred prosecution pledge, in keeping with the shed.

The pair has needed to pay $475 million in consequences and fines to the U.S. and British governments, prosecutors mentioned.

“Today’s sentence shows that foreign officials who abuse their power to commit crimes targeting the U.S. financial system will meet U.S. justice,” mentioned Carolyn Pokorny, the performing U.S. lawyer for the Japanese District, within the shed.