Getty Images

Getty ImagesPetrol manufacturing at Nigerian industry multi-millionaire Aliko Dangote’s $20bn (£15.5bn) cutting-edge oil refinery must be one of the crucial perfect industry information Nigeria has had in years.

However many Nigerians will pass judgement on its luck on two key questions – initially: “Will I get cheaper petrol?”

Sorry, however most probably disagree – except the global value of crude drops.

And secondly: “Will I still have to spend hours watching my hair turn grey in a hypertension-inducing fuel queue?”

Expectantly the ones days are long past however it could partially rely at the behaviour of what Mr Dangote cries “the oil mafia”.

For a lot of the life since oil was once first came upon in Nigeria in 1956, the downstream sector, which contains the level when crude is delicate into petrol and alternative merchandise, has been a cesspit of shady trade in with successive governments closely concerned.

It has all the time been inconceivable to apply the cash, however you realize there’s something dreadfully improper when the headline “Nigeria’s state-owned oil firm fails to pay $16bn in oil revenues”, pops up to your information feed, because it did in 2016.

It’s only within the terminating 5 years that the state-owned Nigerian Nationwide Petroleum Corporate (NNPC) has been publishing accounts.

The Africa head on the Eurasia Crew think-tank, Amaka Anku, hails the Dangote refinery, wherein the NNPC has a 7% stake, as “a very significant moment” for the West African environment.

“What you had in the downstream sector was an inefficient, corrupt monopoly,” she says.

“What the local refinery allows you to do is have a truly competitive downstream sector with multiple players who will be more efficient, profit making and they’ll pay taxes.”

To place it bluntly, the community of this oil-rich people has been conned on a tremendous scale for a few years.

Oil income accounts for just about 90% of Nigeria’s export income however a somewhat tiny collection of industry family and politicians have sated themselves at the oil wealth.

Sides of the industry style were baffling, together with that of Nigeria’s 4 prior to now present oil refineries.

Constructed within the Nineteen Sixties, 70s and 80s, they have got fallen into disrepair.

Closing hour Nigeria’s parliament reported that over the former decade the environment had spent a staggering $25bn attempting and failing to cure the moribund amenities.

So Africa’s biggest oil manufacturer has been exporting its crude which is nearest delicate in a foreign country, a lot to the pride of a few well-connected buyers.

It could be like a bakery with a damaged oven. However in lieu than cure it, the landlord sends balls of dough to some other company that shoves them in a operating oven and sells the loaves again to the baker.

Getty Images

Getty ImagesThe NNPC swaps Nigeria’s crude oil for the delicate merchandise, together with petrol, that are shipped again house.

Precisely how much cash adjustments fingers and who advantages from those “oil swaps” is solely one of the most unknowns in those trade in.

“No-one has been able to nail down who exactly has benefited. It’s almost like a beer parlour gossip about who is getting what,” says Toyin Akinosho of the Africa Oil+Gasoline File.

The NNPC started subsidising the cost of petrol within the Seventies to cushion the squander when international costs soared. Each hour it clawed this a reimbursement through depositing decrease royalty bills – the cash it won for each barrel pumped out of the farmland – with the Nigerian treasury.

In 2022 the subsidy price the federal government $10bn, greater than 40% of the overall cash it accrued in taxes.

On his 2d era in place of business Nigeria’s Vice-President Kashim Shettima referred to “the fuel subsidy scam” being “an albatross around the neck of the economy”.

Nigerian oil skilled Kelvin Emmanuel says in 2019 the rustic’s legit petrol intake “jumped by 284% to 70m litres per day without empirical evidence to justify such a sharp increase in demand”.

Parliament has prior to now reported that – no less than on paper – importers had been being paid in order in way more petrol than the rustic ate up. There was once a bundle of cash to be made exporting one of the crucial subsidised petrol to neighbouring international locations the place costs had been a long way upper.

The NNPC earned billions of bucks a hour from the crude oil manufacturing. However for a few years, beneath earlier governments, a few of its earnings by no means reached the treasury because it was once accused through environment governors and federal lawmakers of together with those inflated subsidy prices on its steadiness sheet.

The NNPC didn’t reply to a request for an interview or a reaction to those allegations however in June denied it had ever “inflated its subsidy claims with the federal government”.

It’ll were the primary income for successive governments however for many years, till 2020, the board didn’t reveal its audited accounts. Its press shed from March this hour promised extra transparency and responsibility.

Then coming to energy in Would possibly 2023, President Bola Tinubu stated the subsidy was once unsustainable and all at once short it – pump costs straight away tripled.

He additionally prevented the coverage of artificially propping up the worth of the native forex, the naira, and let marketplace forces resolve its price.

When he took over, the trade price was once 460 naira to the United States greenback. In November 2024 it was once over 1,600.

The triple trauma of upper gas costs, sporadic shortages of provide and a depreciating forex has been a tricky frame squander for family around the nation, a lot of whom are compelled to run turbines to conserve the lighting fixtures on and telephones charged.

“Beyond the financial burden, the uncertainty and stress of constantly dealing with fuel shortages have added a layer of anxiety to everyday tasks,” is how one Lagos resident summed it up.

“I feel like I’m always navigating through crisis mode. It’s exhausting.”

Getty Images

Getty ImagesBecause the naira plunged and pump costs higher a number of occasions, the federal government, acutely aware of the prospective threat of protests, persevered to pipette some medication to the loads.

In a go which might be likened to swallowing part a paracetamol for acute appendicitis, the federal government made certain family had been paying rather not up to the marketplace price for a litre of petrol.

In alternative phrases, the NNPC was once promoting at a loss and the subsidy was once nonetheless alive.

However with two fresh will increase in October, Nigerians at the moment are paying marketplace costs for gas for the primary life in 3 many years. In the primary town Lagos it went up from 858 naira ($0.52) to one,025 naira consistent with litre.

Probably the most main components in Nigeria’s financial emergency has been a restricted provide of foreign currency echange. The rustic does no longer export plenty services and products in order within the bucks.

However a number of family, together with gas buyers, were chasing the similar restricted provide of foreign currency echange, which results in the naira dropping much more price.

The excellent news is that Mr Dangote’s facility goes to shop for crude and promote delicate fuels in Nigeria within the native forex, which can shed extra bucks to be had for everybody else.

The evil information for the ones hoping this may heartless less expensive gas is that the associated fee Mr Dangote can pay for a barrel of native crude will nonetheless be the naira similar of the global price in bucks.

So if the cost of crude is going up at the international marketplace, Nigerians will nonetheless be compelled to fork out extra naira. Refining in the neighborhood will heartless much less freight prices however that’s a somewhat tiny preserve.

It’s was hoping that the arriving of Mr Dangote’s oil refinery will backup convey a measure of transparency to the field.

He knew he can be frightening a few of those that get pleasure from the murky condition quo when the $20bn undertaking started. However, he says, he underestimated the problem.

“I knew there would be a fight. But I didn’t know that the mafia in oil, they are stronger than the mafia in drugs,” Mr Dangote informed an funding convention in June.

“They don’t want the trade to stop. It’s a cartel. Dangote comes along and he’s going to disrupt them entirely. Their business is at risk,” says Mr Emmanuel, the oil expert.

The fact that there have been some public disagreements with the regulator has only fuelled that suspicion.

Mr Dangote’s refinery near Lagos is thirsty, with a capacity of 650,000 barrels of crude a day.

You would have thought being located in Nigeria would make supply easy but then up pops this headline: “Nigeria’s Dangote buys Brazilian crude”.

It follows a row over supply and pricing. The regulatory authority has complained about Mr Dangote’s negotiating tactics.

Nigeria’s crude oil is low in sulphur and, as one of the most prized in the world, fetches a higher price than many of its competitors.

When discussions over price began, Farouk Ahmed, the chief executive of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), accused Mr Dangote of “in need of a Lamborghini for the cost of a Toyota”.

Getty Images

Getty ImagesMr Dangote has complained of not being allocated as much crude as earlier agreed but even when the price issue is resolved, he will still need to import some crude.

“NNPC doesn’t have enough crude for Dangote. Despite all this instruction to give ample supply of crude to the refinery, NNPC can’t supply Dangote with more than 300,000 barrels per day,” says Mr Akinosho of the Africa Oil+Gas Report.

He says this is partly because the NNPC has pre-sold millions of barrels of oil for loans.

In August 2023 it secured a $3bn loan from the Afreximbank financial institution. In return it is due to supply 164 million barrels of crude.

In September the NNPC admitted it was significantly in debt. It was reported to be owing its suppliers around $6bn for fuel brought into the country.

Nigeria’s oil production has plummeted in recent years from around 2.1 million barrels per day in 2018 to around 1.3 million barrels per day in 2023.

The NNPC has been stressing oil theft as the number one reason why production has dropped.

It says in just one week – from 28 September to 4 October – there were 161 incidents of oil theft across the Niger Delta and 45 illegal refineries were “discovered”.

But Ms Anku believes that “the theft problem is overrated by the NNPC and the oil sector”.

“It’s a convenient excuse,” she provides.

She points to other contributing factors causing the drop in production, including international oil companies selling their on-shore oil fields – some of which may no longer be viable having pumped oil for 60 years.

Getty Images

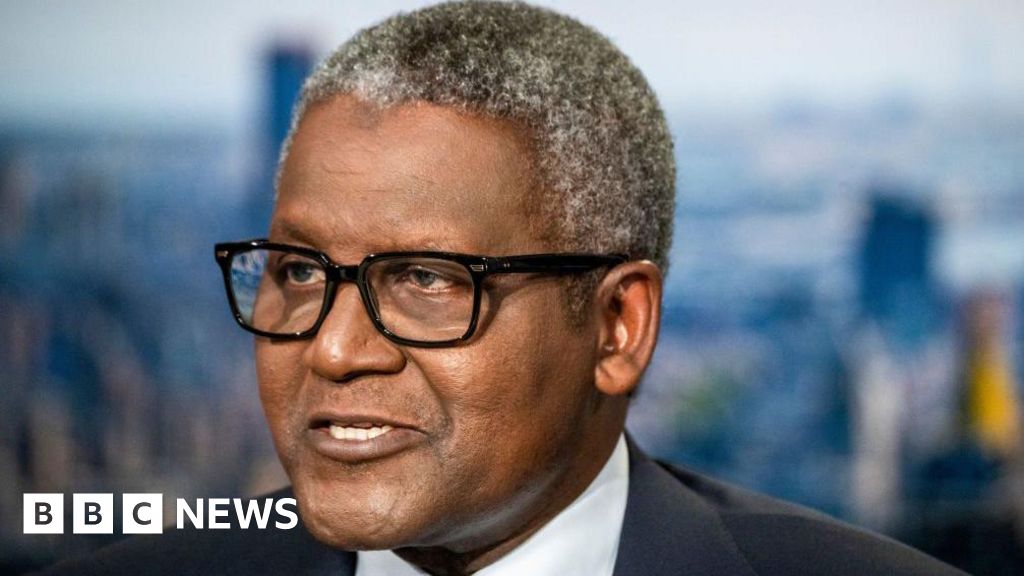

Getty ImagesThe 66-year-old Dangote, who is listed by the Bloomberg Billionaires Index as the second wealthiest person in Africa, made his fortune in cement and sugar.

He has always denied the suggestion that his empire benefitted from links to politicians in power who helped ensure he had a monopoly.

Today there are those who are critical of Mr Dangote’s tactics and amid tension with the regulatory authorities, the same accusation has resurfaced when it comes to the supply of fuel in Nigeria.

“Mr Dangote requested me to restrain issuing licences for importation and that everybody will have to purchase from him. To which I stated ‘Refuse’ as it’s no longer just right for the marketplace. We’ve power safety pursuits,” says Mr Ahmed of the regulatory authority.

Mr Dangote has not commented on the accusation but has said it makes business sense for the traders to buy from his refinery rather than from outside.

A feud between the regulator and Mr Dangote over supplies and pricing has rumbled on and morphed into another row with local fuel traders refusing to buy from the new refinery.

The mud slinging has also included allegations that some traders have been buying up substandard fuel from Russia which is then blended with other products before being shipped into Nigeria.

But not everyone is worried or surprised by the disagreements.

Ms Anku points to lessons learnt from US businessmen back in the 19th Century.

“The JP Morgans and the Stanfords – they didn’t have it simple both. That’s why they needed to proceed and get govt aid and subsidies to form their railways and so forth.

“I see the drama as a very normal process as you’re changing the structure of the economy. There are losers, they lash out. There’s no chance they’ll stop the refinery from working or selling its products to the Nigerian markets… in my view.”

The fashionable, native refinery has additionally ended in a debate over the component of gas available on the market. It’s an notable factor given the immense collection of turbines belching out fumes throughout Nigeria because of the woeful energy provide.

“Every day I wake up to the smell of what I’m sure [could] kill me. It’s because of the quality of the diesel,” says Mr Akinosho.

He sees Mr Dangote’s refinery as an actual alternative for upper component petroleum merchandise in Nigeria which might be higher for each automobile engines and family’s lungs.

However presently, Nigerians being collision brittle within the area would possibly in finding it tough to be positive.

Arguments between officers on the Dangote refinery, the oil entrepreneurs and the regulators are batted from side to side within the media. Each side were accused of hiding some details and figures which leaves family guessing what’s going on within this nonetheless fairly unclear business.

“Everyone is a villain. There are no heroes here,” concludes Mr Akinosho.

Extra Nigeria tales from the BBC:

Getty Photographs/BBC

Getty Photographs/BBC